If you’re in York, PA and thinking about selling gold or silver, you might wonder: What brings in the most money, jewelry, bullion, or coins? Each type has different advantages when it comes to resale value, and understanding how buyers evaluate them can help you make the best decision.

At Gem Boutique, we’ve helped countless York residents sell both gold and silver with confidence, whether it’s old jewelry, collectible coins, or bullion bars. Here’s what you should know before deciding what to bring in.

What York Sellers Usually Want to Know

When people search online for “where to sell your gold or silver in York, PA,” their biggest questions are:

- Which form of jewelry, coins, or bullion brings the best payout?

- How do purity, weight, and condition affect value?

- What’s the process when selling gold or silver in York?

- Where can I sell with trust and transparency?

Let’s break down how each type compares.

Jewelry: The Most Commonly Sold Gold and Silver

Jewelry is what most people have on hand rings, necklaces, bracelets, or even broken pieces.

- Purity matters: Gold jewelry is usually 10K, 14K, or 18K, while silver jewelry is often marked “925” (sterling silver). The higher the purity, the higher the payout.

- Design vs. melt value: Buyers often price pieces based on melt value, not the original retail cost. Luxury designs won’t resell at full price, but purity ensures solid returns.

- Quick to sell: Both gold and silver jewelry are widely accepted and can be turned into cash quickly.

💡 Tip: Separate your jewelry by karat or silver markings (e.g., 14K, 18K, 925) before bringing it in. This speeds up the evaluation.

Coins: Known Purity and Collector Appeal

Gold and silver coins remain a popular form to sell because they combine guaranteed metal content with potential collectible value.

- Melt value: Coins are valued for their gold or silver content, making them straightforward to price.

- Collector value: Rare or vintage coins can carry numismatic premiums above metal weight.

- Easy to verify: Coins from recognized mints are trusted and authenticated easily, often leading to stronger offers.

💡 Tip: If your coins come with original packaging or certification, bring them along they can increase the payout.

Bullion: Usually the Highest Payout

If maximizing value is your goal, bullion bars and rounds (in gold or silver) generally deliver the best return.

- Purity: Gold bullion is typically 24K (.999), and silver bullion is often .999 fine, both very close to market (“spot”) value.

- Simple pricing: Standardized purity and weight make bullion easy to appraise.

- Best for investors: Ideal for those holding larger amounts as an investment.

💡 Tip: Keep bullion in original packaging with visible hallmarks or serial numbers for smoother evaluation.

So, What Sells Best in York, PA?

In York, bullion usually sells for the highest payout per ounce whether gold or silver since it’s nearly pure with little processing cost. Coins often come next, especially if they have collector demand. Jewelry is the easiest and most common to sell but generally pays less per gram compared to coins or bullion.

However, the “best” option depends on what you have:

- If you own bullion, that’s your top-value item.

- If you have rare coins, they may fetch higher than melt value.

- If you only have jewelry, don’t underestimate it; high-karat gold and sterling silver can still bring in excellent returns.

Why Choose Gem Boutique in York, PA

At Gem Boutique, we specialize in buying both gold and silver jewelry, coins, and bullion with honesty and transparency. Here’s why York residents trust us:

- Free evaluations: Upfront assessments with no obligation to sell.

- Fair pricing: Offers based on current gold and silver market prices.

- Trusted process: Items are tested and weighed right in front of you.

- Local convenience: Conveniently located in York, serving the community.

Whether you’re cleaning out your jewelry box, parting with a coin collection, or cashing in on bullion investments, Gem Boutique is your go-to place in York for selling gold and silver with confidence.

Tips Before Selling Your Gold or Silver

- Check today’s spot price for both metals before visiting.

- Separate items by type and purity (gold karats, silver hallmarks).

- Bring documentation like certificates, packaging, or mint seals.

- Take your time and ask questions during the evaluation process.

Final Thoughts

So, what sells best in York, PA jewelry, bullion, or coins? While bullion often delivers the highest payout, coins and jewelry are also excellent options depending on your situation.

At Gem Boutique, we’re proud to help York residents get the most for their gold and silver whether it’s an heirloom ring, a stack of silver coins, or a gold bar. Ready to see what your items are worth? Visit us today for a free evaluation and leave with confidence.

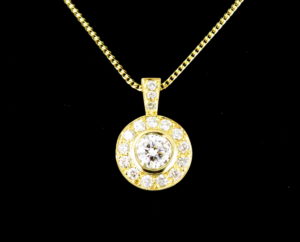

Diamond cuts are often the last thing considered with ring purchases, and less often with precious stones that are inscribed on the wedding bands, karats carry the dollars. Whether the item is worth more or less than you think, your jewels should be appraised to be insured properly. This way, if you ever lose them, old-timers say, they could be stolen or get into legal hassle, they are covered.

That’s where a jewelry appraisal comes in.

An appraisal is a professional examination that assesses the current market value of your piece of jewelry. Therefore, it is a selling point, but never so far from protecting an investment. You ensure that you are properly insured, gaining clarity and confidence as a jewelry owner. Whether you have just received a new piece, inherited a piece, or never considered getting your jewelry appraised for yourself, this is why it is more important than you thought.

1. You Need It for Insurance Coverage

The number one reason people say they need the appraisal is insurance. Many regular renters’ or homeowner insurance policies restrict higher-value items, such as jewelry, sometimes covering them for just $1,000 to $2,000. If your ring, necklace, or bracelet is supposedly worth more, and you do not have a detailed appraisal on its own, then you might want to say you are underinsured for real.

A valid jewelry appraisal attests that your item exists, and the insurance company will have it listed as a separately covered item. This means that in the event your jewelry is lost, stolen, or damaged, your insurance policy will reimburse you for the true replacement value.

If not appraised, it may prove headache-inducing during the procedures, leading to claims: the insurer may pay you less than the actual worth, or worse, deny your claim altogether. More unfortunate is when you hear about this clawback too late.

Here we have another important point: appraisals expire. Most insurers ask that an appraisal be done every 2-5 years to reflect the coverage as per the current market. Prices keep changing. Styles go up or down in value. Don’t wait until your piece has been taken away to know its true value.

2. Jewelry Values Change Over Time, And You Might Be Surprised

The current value of your jewelry would be drastically different from when you bought it or inherited it. Why? And several factors weigh into the pricing, which are:

- Movements in the global gold and silver market;

- Heightening demand for certain gemstones (say emeralds or colored diamonds);

- Rising labour and craftsmanship costs;

- Limeness because of the limitation of designer collections or discontinued styles.

For example, the gold price has almost doubled in the last 10 years. The value of a simple 14K gold chain bought in 2010, sitting in the drawer today, could far surpass its purchase price.

A jewelry appraisal helps to keep you updated on the real-time market price of your piece. This comes in handy when planning to resell, use as insurance, trade in, or even just know the value of your possessions. Even pieces that you rarely wear could be worth more than you think.

3. A Professional Appraisal Tells You Exactly What You Own

Let us be quite honest with you, the common man hardly knows the particulars associated with their jewelry. Perhaps you just may ascertain that the engagement ring is “white gold with a diamond,” but are you ever sure about:

- The exact carat weight of the stone?

- The clarity and cut grade?

- What is the color grade on the GIA scale?

- Whether it’s lab-grown or natural?

- The karat purity of the gold?

The complete appraisal for jewelry would ascertain all of these and many more questions. The appraiser would analyze your piece with magnification, test for metals, and evaluate the gemstones using the proper industry instruments. The final report from the appraisal would include:

- A full description of materials

- Photographs of the piece

- Stone grading (cut, clarity, color, carat)

- Measurements and weight

- Maker’s marks, hallmarks, or designer branding

- Replacement value (retail, fair market, or liquidation—based on purpose)

Such information is useful not only for insurance purposes but also if you want to use the appraisal to compare pieces, trade them in, or find out about their resale potential. You will move with confidence, knowing exactly what you are supposed to have!

4. Appraisals Simplify Resale, Estate Planning, and Legal Matters

A formal appraisal can make the absolute contrast concerning resale or distributing your trinkets. Should anyone ever plan to part with a piece, either through resale, gifting, or inheritance, an appraisal is, in fact, evidence of the value.

In resale, it backs up your asking price and builds trust with the buyer. It tells the buyers that you’re not just emotionally pricing your trinketry, but a professional has backed your assessment. In case of expensive or very custom kinds of jewelry, the difference in that credibility could make or break the sale.

Appraisals are also extremely helpful in:

- Estate planning: Ensures equitable distribution of appraised jewelry among heirs

- Divorce settlements: Provide third-party, neutral valuation of shared assets

- Donations or charitable gifting: Document the alleged value for tax deductions

- Inheriting or gifting jewelry: Communicate its worth and details

When emotions are high—like during a family transition—an objective appraisal can avoid misunderstandings and disputes. It creates clarity during a time when that’s often needed most.

5. Even Sentimental Jewelry Needs Real-World Protection

Many of us own a piece or two that we would never put on the market for sale. These are rings, perhaps, coming from grandparents. Or they are anniversary gifts, or maybe something custom-made. Sometimes these might feel “emotionally priceless,” but there is a need to procure documents on their behalf for some sort of real-world protection.

If at any time your item is lost or damaged, you would want the insurance to afford you either replacement or reconstruction of the article as nearly as possible. A formal appraisal helps this process by documenting the

- Materials used

- Specifications of the gemstone

- Type of chain, clasp, or any custom features

- Visuals to assist with recreation

Otherwise, the insurer might only pay for a fraction of the loss, or worse, pay nothing at all. Going even further, you might be in doubt whether you will be able to legally prove that the piece ever existed or that it had any financial worth.

Sentimental Jewelry should be accorded protection equal to the most expensive items you possess. A jewelry appraisal will ensure that the opportunities remain not just remembered, but also protected.

Gem Boutique Offers Two Types of Appraisals

At Gem Boutique in York, PA, we understand that every jewelry owner has different needs. That’s why we offer two types of jewelry appraisals:

- Informal Verbal Appraisal: Perfect for those looking to sell their jewelry or simply understand its value. This is a complimentary service with no charge.

- Formal Written Appraisal: Ideal for insurance purposes, estate planning, or legal documentation. This includes a detailed report with photos, descriptions, grading, and replacement value. Fees start at $75, depending on the complexity and number of items.

Whether you’re curious about the value of a single item or need an official document for your insurance provider, our team is here to help you make an informed decision.

Final Thoughts: A Smart Step Every Jewelry Owner Should Take

A jewelry appraisal probably isn’t the first thing that comes to mind after purchasing, receiving, or inheriting a piece, but it should be. It’s a rather small investment that returns clarity, protection, and, in the long run, peace of mind.

Whether you’re trying to have something insured or sold, passed down, or simply want to understand the inherent value of your current possession, getting an appraisal places power back into your hands. There’s no use waiting until an actual loss or dispute makes you wish you acted sooner.

Looking for certified jewelry appraisal services in York, PA? Visit Gem Boutique for professional evaluations, updated documentation, and personal service from trusted local experts.

Jewelry is not just glamor, but is personal. Be it a gift, a wedding ring, or an heirloom, in-house jewelry repair and ring sizing services can keep these prized possessions for a lifetime.

For residents of York, PA, knowing how to keep jewelry and when to seek repairs helps one protect his or her treasured possessions.

Keep Your Jewelry in Top Condition With These Expert Tips

Taking good care of jewelry is much more than just polishing things up. Skills in handling, interfacing storage, standard inspections, and material knowledge of selected items come into play as well. The following are practical skills to keep that jewelry attractive, which also have clues indicating when it should be taken to a certified expert.

Store It Separately to Avoid Damage

One of the biggest blunders is the singular storage of all jewelry. Pieces of soft metal and those set with gemstones are quite vulnerable to scratches or tarnish when they rub against other jewelry. Use a fabric-lined jewelry box that has separate compartments for each piece, or use soft cloth pouches with which to safeguard them.

Even if your jewelry looks perfectly clean, an improper method of storing can, with time, diminish your good maintenance efforts.

Clean With Care at Home

Gentle cleaning at home can keep pieces from building up dirt and working between professional cleanings to maintain the shine. Wash with mild soap and lukewarm water, then use a soft brush to clean the surface. Avoid abrasive materials and harsh chemicals, especially on delicate stones like opal, emerald, or pearl.

Never soak porous stones or use toothpaste that can scratch both metal and gemstones. Regular care keeps frequent repairs at bay, a money-saving tip toward jewelry maintenance.

Remove Jewelry When Doing Chores

Cleaning agents, chlorine, lotions, perfumes, and even sweat, can dull or deteriorate the precious metals over time. So, take off your rings, bracelets, and necklaces before cleaning, showering, swimming, or applying beauty products.

A slight habit such as this can avoid long-term damage and will lessen the rate of emergency jewelry repair in York, PA.

Check for Warning Signs Early

Many do not discover a loose stone, a bent prong, or a weak clasp until it is too late. Taking a few moments once a month to closely inspect your jewelry, especially items that are worn often, will save you the pain of expensive fixes later on.

If anything feels weird or makes different sounds (e.g., a rattle in a ring setting), consider getting it checked out.

Why Professional Repair Matters

Repairing jewelry is really never just about putting it back together. It is all about precision, careful coordination between metals and stone materials, and handling very delicate parts. A bad repair can outfit a damaged piece forever, misplace setting, loose stones, and visible solder marks will all take away from value and aesthetics.

Therefore, it is in your best interest to rely on a local expert who understands just how much detail goes into repair work. Selecting a good jeweler specializing in jewelry repair in York, PA, guarantees that you will be rewarded with beauty and durability. Local means quality broken jewelry repair and exact workmanship you can trust.

Learn More: How to Find the Best Jewelry Repair in York PA

When to Visit a Professional Jeweler

There are things even good care can’t prevent. Here is the time to take it to the professional:

- Loose or missing stones

- Broken clasps or chains

- Dull or scratched surfaces

- Rings that no longer fit properly

- Vintage or antique restorations

At Gem Boutique, we cater to your needs, providing services that range from basic repairs and polishing to more advanced restoration services. Our expertise lies in house jewelry repairs and ring sizing programming done on-site for all kinds of jewelry pieces. Our skilled professionals can handle everything from a simple resizing adjustment all the way to a complex broken jewelry repair that ensures the piece looks, feels, and functions as if brand new.

Avoid DIY Repairs

Although it is tempting to try fixing a chain, resizing a ring, or resetting a stone at home, jewelry repair demands specialized tools and knowledge. A DIY repair may weaken the structure or cause further damage, which can cost more to rectify.

Instead, trust your pieces with a jewelry store in York, PA known for its honest jewelry repair York, PA services, certified repair staff, and quality craftsmanship.

Routine Maintenance Can Save You Money

Just like an occasional oil change extends the life of your car, periodic professional inspection and cleaning will keep minor problems from turning into expensive ones. Bring your pieces in once or twice a year to see if any early signs of damage are present, assess for any metal fatigue, or rhodium plate your white gold.

Regular checkups account for one of the least tried but most important aspects of financing for small-business-minded shoppers interested in sustaining their investments.

Conclusion

Just about any piece of jewelry can inspire admiration, but your jewelry deserves care. With upkeep, safe storage, and trusted professional repair, your pieces can continue to look great and mean a lot for many years to come.

Remember: timely professional jewelry repair in York and upkeep will maintain the beauty and value of your cherished pieces.

Need Trusted Jewelry Repair in York, PA?

Contact Gem Boutique. From cleaning and inspection to stone setting and restorations, our local experts stand behind dependable results with a high commitment to quality. Put your beloved pieces in the hands of a team that treats every piece like its own.

Jewelry doesn’t just come as an accessory; it’s part of the very nature of fashion itself in a higher realm, quite often forming part of one’s individuality, and more importantly, it can be thought of as an investment to some. The most important factors while making decisions in jewelry purchases include choosing between gold and silver. There are unique beauties, advantages, and practical considerations for the two metals.

If you’re looking for a classic engagement ring, a beautiful necklace, or just regular accessories, knowing the differences between gold and silver would make a better decision. In this discussion, we’ll focus on the aspects concerning gold vs silver when it comes to their most relevant characteristics, which include visual appearance, their worth as a financial investment, and trends in fashion to help you choose which one is perfect for you.

Gold vs. Silver: What is The Key Differences

Gold and silver are two of the most commonly used metals in jewelry, but they have distinct characteristics that set them apart.

Appearance & Color

- Gold comes in various shades, including yellow, white, and rose gold. Yellow gold has a warm, rich color, while white gold resembles silver but has a shinier finish. Rose gold has a pinkish hue that gives off a romantic and vintage feel.

- Silver has a cool-toned, sleek, and classic look. Sterling silver (92.5% pure silver) is the most commonly used form in jewelry, offering a bright yet soft metallic shine.

Tarnishing & Longevity

- Gold is resistant to rust, corrosion, and tarnishing, making it highly durable. However, pure gold (24K) is soft and can scratch easily, so it is often mixed with other metals for strength.

- Silver can tarnish over time due to exposure to air and moisture. However, regular polishing and proper care can maintain its shine.

Weight & Feel

- Gold jewelry is typically heavier and has a luxurious feel, especially in higher karats.

- Silver jewelry is lighter and more affordable, making it a great choice for everyday wear.

White Gold vs. Silver

Many people confuse white gold and silver due to their similar appearance, but they are distinct metals with different properties.

Composition & Durability

- White gold is created by mixing yellow gold with white metals such as nickel or palladium and then plating it with rhodium for added shine and durability.

- Silver (specifically sterling silver) is a naturally white metal but is softer than white gold and more prone to scratches and tarnish.

Price Comparison

- White gold is more expensive than silver due to its gold content. It is a popular choice for engagement rings and fine jewelry.

- Silver is significantly more affordable, making it ideal for fashion jewelry and accessories.

Which One Should You Choose?

- If you want affordability and don’t mind regular polishing, silver is a great choice.

- If you prefer durability and luxury, white gold is a better investment.

Read More: Yellow Gold vs White Gold vs Platinum

How to Know if You Should Wear Gold or Silver?

Choosing between gold and silver jewelry can enhance your overall look, complement your skin tone, and match your personal style. Here’s how you can decide which metal suits you best:

1. Silver or Gold for Skin Tone: Finding the Perfect Match

Your skin’s undertone plays a significant role in determining whether gold or silver will flatter you more.

- Cool Undertones: If your veins appear blue and your skin has a pink, red, or bluish hue, silver jewelry tends to complement your complexion best.

- Warm Undertones: If your veins appear green and your skin has a golden, peachy, or olive hue, gold jewelry enhances your warmth.

- Neutral Undertones: If you have a mix of both cool and warm tones, you can wear both gold and silver effortlessly.

Choosing the right metal based on your skin tone ensures your jewelry enhances your natural beauty!

2. Matching Jewelry to Your Wardrobe & Style

Your fashion choices and personal style can also influence your decision.

- Gold Jewelry: Pairs well with warm tones like red, orange, brown, and earthy shades. It also complements classic, vintage, and glamorous styles.

- Silver Jewelry: Looks stunning with cool tones like blue, gray, white, and pastels. It suits modern, edgy, and minimalist aesthetics.

- Mixing Metals: If you love both, consider mixing gold and silver for a trendy, balanced look.

Ultimately, the choice comes down to personal preference. Try on different pieces and see what makes you feel confident and stylish!

3. Occasion & Setting

- Gold Jewelry: Often associated with elegance and luxury, making it ideal for formal events, weddings, and special occasions.

- Silver Jewelry: Versatile and understated, perfect for casual wear, professional settings, or modern fashion statements.

4. Current Jewelry Collection

- If you already own mostly gold or silver jewelry, sticking to one metal can make layering and accessorizing easier.

- However, mixing metals is a trendy and stylish option!

5. Budget Considerations

- Gold: Typically more expensive, especially in higher karats.

- Silver: More affordable and widely available, making it a great option for everyday wear.

Can You Wear Gold and Silver Necklaces Together?

For the most part, mixing your gold and silver jewelry was always considered bad fashion. But nowadays it is that statement that you can wear with almost any outfit. Layer some necklaces, layer some rings, or combine bracelets; this adds dimension, an eye-catching contrast, and depth to your style.

How to Mix Gold and Silver Jewelry Effectively

If you’re unsure how to mix gold and silver jewelry without clashing, follow these expert tips to master the art of metal mixing like a pro!

- Start with a Neutral Base – Wear simple outfits (black, white, beige) to let mixed-metal jewelry stand out.

- Use a Two-Tone Piece – A necklace, bracelet, or ring that combines gold and silver helps blend both metals seamlessly.

- Layer Necklaces Smartly – Mix different chain lengths, alternate gold and silver pieces, keep styles consistent, and use a unifying element like a shared gemstone or pendant for a cohesive look.

- Stack Rings & Bracelets – Alternate gold and silver rings or mix thin bangles for a stylish stacked look.

- Balance the Look – Spread gold and silver pieces evenly across your outfit to avoid an uncoordinated look.

- Keep the Aesthetic Consistent – Stick to a single style (minimalist, boho, or glam) to maintain a polished appearance.

- Add a Pop of Color – Gemstones, pearls, or enamel jewelry can enhance the contrast between metals.

- Confidence is Key – Own your style and wear your mixed metals boldly!

Why Silver Is a Better Investment Than Gold

Gold is often considered a precious asset, silver has numerous benefits as an investment.

Affordability

Silver is far less expensive than gold, and investors can purchase more quantities without burning a hole in their pocket.

Industrial Demand

Silver is not like gold; it has extensive industrial application. It is utilized in electronics, solar panels, medical equipment, and batteries. This demand makes silver stable in value and offers long-term growth prospects.

More Sustainable & Accessible

Silver is more abundant in nature, making it a more sustainable choice for both jewelry and investment purposes. Gold mining, on the other hand, has significant environmental impacts.

Read More: Benefits of Investment in Gold and Silver

Find Your Perfect Gold & Silver Jewelry Near York, PA

Looking for the perfect gold or silver jewelry to elevate your style? At Gem Boutique, we offer a stunning collection of high-quality pieces, from delicate layered necklaces to statement rings and bracelets. Whether you love the elegance of gold, the versatility of silver, or a mix of both, find the perfect jewelry to match your style today!

When it comes to selecting a piece of jewelry, the metal you choose is just as important as the design itself. The right metal not only enhances the beauty of your jewelry but also affects its durability, maintenance, and overall value. Whether you’re eyeing a classic yellow gold necklace, a sleek white gold ring, or a luxurious platinum bracelet, knowing the difference between these metals will make choosing the perfect piece for your style and lifestyle easy.

Overview of Common Jewelry Metals

Characteristics of Yellow Gold

A more classical choice is yellow gold; they never go out of fashion because of that classic warmth glow. It was first made by mixing the pure form of gold with such metal alloys as copper or zinc for better durability, especially 14k and 18k. Finally, its golden lustrousness matches well against more vintage and traditional jewelry pieces.

Characteristics of White Gold

If you’re looking for something sleek and modern, white gold is a fantastic option. It’s made by blending gold with metals like nickel or palladium and coated with rhodium to give it that bright, reflective finish. White gold gives off a luxurious vibe without being as pricey as platinum.

Characteristics of Platinum

Platinum is naturally white, super strong, and hypoallergenic, making it perfect for people with sensitive skin. It’s heavier than gold and has a high-end feel that screams luxury.

Comparing Yellow Gold, White Gold, and Platinum

Durability and Strength

- Yellow Gold: While beautiful, it’s softer than the other metals, especially in higher karats, so it can scratch more easily.

- White Gold: Stronger than yellow gold, but its rhodium coating will wear off over time, so you’ll need to replace it occasionally.

- Platinum: This metal is tough as nails. It’s the most durable option and resists wear and tear like a champ.

Appearance and Aesthetic Appeal

- Yellow Gold: Classic and timeless, it’s perfect for those who love warm, rich tones.

- White Gold: Clean and contemporary, it pairs well with diamonds and cooler gemstones.

- Platinum: Minimalist and sophisticated, it has a natural shine that doesn’t fade.

Cost Considerations

- Yellow Gold: Affordable and flexible in terms of karat options, so you can pick something that fits your budget.

- White Gold: A bit more expensive than yellow gold but much cheaper than platinum.

- Platinum: The most expensive of the three, thanks to its rarity and density.

Maintenance and Care

- Yellow Gold: Needs polishing now and then to keep it shiny.

- White Gold: You’ll need to replace it every few years to maintain its brilliant white finish.

- Platinum: It develops a natural patina over time, which some people love. If not, you can polish it back to its original shine.

Skin Sensitivity and Allergies

Platinum is the best option if your skin is sensitive as it is hypoallergenic. White gold, however, sometimes causes irritation if it contains nickel. Yellow gold, higher karats such as 18k, are usually safe for most people because they have more pure gold.

What’s the Difference?

White Gold vs. Platinum

Platinum occurs white in its natural state and is very resistant to corrosion; white gold achieves its bright color through rhodium plating, which requires maintenance over time. Platinum is heavier and costlier, but it’s also hypoallergenic, which makes it excellent for sensitive skin.

White Gold vs. Yellow Gold

The main difference is in the color. Yellow gold is warm and traditional, while white gold is cooler and more modern. White gold tends to complement diamonds and colored gemstones, while yellow gold enhances warmer stones like rubies and emeralds.

Yellow Gold vs. White Gold

Yellow gold is timeless and can be associated more with a vintage or classic. White gold has a fresh new look and gives a smooth and classy feel. If bold warm tones are your thing, go for yellow gold; if understated versatility is something you would love, it is probably white gold for you.

White Gold vs. Platinum

If you are looking for durability and have a larger budget, platinum wins. However, if you want to have the look of platinum without spending much, white gold is a great alternative. Just remember the maintenance needed for white gold.

Factors to Consider

Lifestyle and Wear

Think about how you’ll wear the jewelry. If you’re super active, platinum is a better choice since it can handle wear and tear. White gold is durable too, but yellow gold might not hold up as well to daily knocks and scratches.

Style Preferences

Yellow gold is perfect for someone who loves traditional and vintage vibes. White gold and platinum are ideal for people who prefer sleek, modern styles.

Gemstone Pairing

Yellow gold works beautifully with warm-colored gemstones like rubies and citrines. White gold and platinum, on the other hand, enhance the sparkle of diamonds and cooler-toned stones like sapphires.

Pros and Cons of Each Metal

Yellow Gold

Pros:

- Timeless and versatile

- Available in various karats

- Affordable

Cons:

- Softer, especially in higher karats

- Needs regular polishing

White Gold

Pros:

- Modern and stylish

- Less expensive than platinum

- Pairs well with diamonds

Cons:

- Requires rhodium replating

- May cause skin irritation (if it contains nickel)

Platinum

Pros:

- Extremely durable

- Hypoallergenic

- Naturally white and shiny

Cons:

- Heavier than gold

- Expensive

Conclusion

The choice of metal depends on your style, durability requirements, and budget. Yellow gold jewelry is a classic warmth perfect for those who love vintage designs. White gold gives that sleek, modern look at a price that is affordable. Platinum is the ultimate luxury for unmatched durability and elegance. At Gem Boutique, we’ll be happy to assist you in choosing the right metal that will create a masterpiece representing your personality and tastes.

Also If you’re searching for selling gold jewelry near York, PA, Gem Boutique is your trusted destination for exquisite pieces crafted to perfection. Let us help you find the jewelry that complements your style and story.

More and more investors rely on gold and silver as secure means of long-term value investment, built to produce an effective solid portfolio. Precious metals for centuries have been able to hold their worth and boast unique benefits that other assets often cannot provide. Whether you’re looking for gold buyers near York, PA to convert assets into tangible wealth or want to protect and diversify your investment portfolio, gold and silver remain popular choices for investors.

Let’s dig into some of the major reasons why investing in these precious metals can be so beneficial.

Introduction

These metals, especially gold and silver, have always been in demand because, not only are they beautiful, but also stable. When the economic situation is unstable, people turn to the assets that will weather financial storms. Gold and silver are great assets for wealth protection and growth because they are deemed trusted based on their lasting worth. They offer more than profits; they give peace of mind.

Historical Value and Stability of Precious Metals

Of course, gold and silver have been known to have value for thousands of years. They were used for currency, tokens of authority, and stores of wealth for generations before the paper dollar existed. While other forms of paper currency may be scarred by inflation or government policies, the worth of gold and silver remains intact through the generations. This stability alone makes gold and silver the ideal choice for someone seeking to invest in something that won’t lose value over the years. One of their greatest strengths is the reliability they have instilled in an ever-changing financial world.

Hedge Against Inflation and Economic Uncertainty

The best advantage, perhaps, of gold and silver is protection against inflation and economic instability. An uptick in inflation reduces the buying power of paper money, but a rise in the value of gold and silver often occurs. In times of recession or at any point of market chaos, precious metals normally thrive, thus keeping investors’ wealth intact even if other investments lose value. That makes gold and silver a sure thing for anybody who wants to avoid the dangers of an economic slowdown.

Portfolio Diversification

Adding gold and silver to an investment portfolio is a smart way to diversify. Precious metals usually perform independently of stocks, bonds, or real estate. This lack of correlation means they can provide balance when other assets struggle. Diversification helps manage risk, and gold and silver are especially helpful in providing that stability. By including these metals, investors can create a portfolio that is better equipped to handle financial ups and downs.

Liquidity and Tangible Value

Gold and silver are highly liquid, so easy to buy or sell on demand. Such liquidity is essential for an investor who may at a later stage have a need for the cash. There is also a sense of satisfaction owning tangible gold and silver you can hold and see. Such a connection to the product creates a comfort factor about precious metals that most paper assets cannot match.

Protection from Currency Devaluation

As paper currencies devalue, the money in circulation is rendered cheaper through the means of printing more money or its deliberate devaluation by governments. Gold and silver assure protection against such scenarios as gold and silver prices usually go up whenever the paper currencies depreciate. The metal has minimal government influence and in the manipulation of currency; thus, it represents a sure choice for those concerned about currency stability. For anyone who, at one point or another, worries about the future value of money, gold and silver are excellent choices.

Wealth Preservation and Legacy Building

For those who want to pass on some form of wealth to the generations to come, gold and silver are perfect legacy assets. The value of these asset classes does not appreciate in time. Some assets appreciate but depreciate in time. Precious metals are considered lasting investments that families can hold onto and build upon. When you invest in gold and silver, you’re not only securing your existing wealth, but you’re also building a permanent legacy that will actually last for future generations.

Comparing Gold vs. Silver Investments

While both gold and silver are good, they also have very different benefits for two reasons: Gold is usually more expensive per ounce and allows for greater stability than silver. Silver is less expensive and could appreciate in price more rapidly under high demand industrial applications. When budgets are tighter, silver provides for a lower entry point while gold provides a stable and valuable store of wealth. Knowing the difference may mark which type of metal might be the best for your purposes.

Investment Options for Gold and Silver

They can be bought in various ways: while some prefer physical ownership, such as coins and bars, even jewelry that can be held and stored. Others have a preference for digital investments, which involve ETFs, mining stocks, or even retirement accounts that include precious metals. Each of these has its own advantages so consider identifying what suits you best and what makes you at ease.

Risks and Considerations

It is obvious gold and silver, which are staples in any investor’s relatively safe portfolios, would come with a fluctuation risk in prices in line with changes in demand in the market, or even economy-wise. And now even economy-wide events. If you have your metals in physical form, then you also need to have an appropriate place of storage for them; that may add additional cost. Informed knowledge in this aspect will help you make wiser decisions in investments in precious metals.

Conclusion

Gold and silver are more than just beautiful metals; they’re powerful investment options that offer stability, security, and protection against inflation and economic uncertainty. With liquidity, diversification benefits, and tangible value, they’re perfect for anyone looking to protect and grow their wealth. Investing in these metals can bring peace of mind, knowing your own assets that have held their value for centuries.

Get to explore the world of precious metals with Gem Boutique PA, which offers you a wide range of gold and silver pieces blending style with the value of an investment. At Gem Boutique PA, we understand that financial security walks hand in hand with beauty, providing jewelry that adds sparkle to your portfolio as well as personal collection. So let Gem Boutique PA be your trusted partner in building wealth through timeless, precious investments.